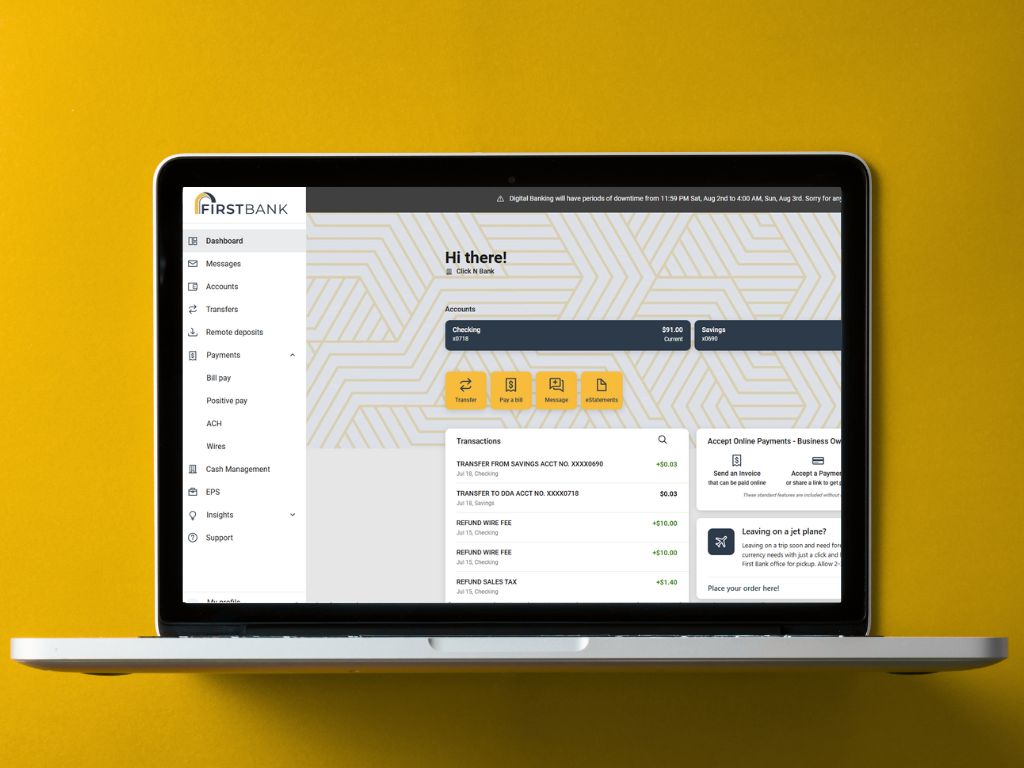

First Bank's Cash Management banking services are now available to our business customers through our Digital Banking platform. Manage your business accounts 24/7 with a cash management system that allows you to have multiple users, who can each be assigned to managed or view certain accounts or initiate specific transactions.

Digital Banking

First Bank's Cash Management services have been built for users who require tools and solutions for situations your business encounters through daily operations, transactions and managing business finances.

Whether you are looking to manage accounts at a high level or utilize some of First Bank's best-in-industry solutions, Cash Management lets you conveniently handle your organization's finances whether you are online or through our mobile app. Do your banking in the comfort of your home or office; all you need is a connection and you will be able to access these account features:

- Check account balances

- Review your statements

- Reconcile your accounts

- Transfer money between accounts (transfers between accounts may be posted the next business day.)

- Make loan payments

- Download and print account activity

Other integrations into the Digital Cash Management services include:

- ACH Origination

- Positive Pay

- Wires

- Deposit Systems

- E-Statements

- Messages

- Bill Pay

%20(1).jpg)

ACH Origination

ACH Origination

Process payments faster, improve cash flow, and manage and track all your incoming and outgoing payments in one place. The easy and secure initiation of ACH files means you can pay your employees and vendors – plus send and receive business payments – all within your digital banking experience.

ACH Origination is a more secure way to process payments, eliminating checks, check writing and postage -- saving you time and money!

Positive Pay

Positive Pay

By stopping fraudulent checks from posting to accounts, businesses can protect themselves and minimize loss. Given the ease of paying by check, Positive pay is one of the most effective tools businesses use to prevent check fraud. When using Positive pay, users can:

- Upload files with check details

- Manually enter check details

- Work check exceptions

Wire Transfers

Wire Transfers

Wire transfers are one of the quickest and safest ways for sending money and ensuring funds are securely paid by electronic payment. Paying vendors, suppliers, and individuals has never been easier (or faster). Using Wires in First Bank's digital platform, users can:

- Create and edit wires

- Review and initiate wires

- View wire history

- Create wire templates

- Create recurring wires

E-Statements

E-Statements

Your financial security matters and First Bank e-statements are designed to give you more control and protection than paper ever could.

Paper statements may seem reliable, but they expose your business information to risks like theft, loss, or mis-delivery. In fact, identity theft is the #1 reported consumer complaint with the Federal Trade Commission. Once stolen, your bank account details could be used for identity theft or fraud.

Messages

Messages

Messages in Cash Management is designed to ensure your team will have a private and secure channel for conducting sensitive business matters, whether that wire approvals, exchanging documents or confirming transactions. Business users have these conversations in confidence, even First Bank can’t view them. If your team needs support from us, they can simply start a new conversation with our First Bank customer service team.

Online Bill Pay

Online Bill Pay

Your time is too valuable to spend it paying bills with checks. Now you can have increased control, greater flexibility and more time to spend on your business. That’s why it pays to check into Business Bill Pay from First Bank. It’s a better way to handle your back office.

Business Bill Pay lets you:

- PAY bills anywhere, quickly and easily

- ACCESS bill pay anywhere on your schedule

- SET UP recurring payments for monthly bills

- SAVE time and money by sending electronic payments

To sign up, log-in to your Digital Banking account, then click on the “Bill Pay” link to access the enrollment form. To answer all your questions, download the Business Bill Pay FAQ.

AUTOBOOKS

Interested in using our digital invoicing system? Autobooks is available within our Digital Bank and is free to our Digital Banking customers.